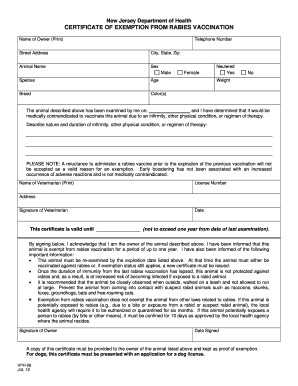

NJ VPH-28 2007 free printable template

Show details

Describe nature and duration of infirmity other physical condition or regimen of therapy PLEASE NOTE A reluctance to administer a rabies vaccine prior to the expiration of the previous vaccination will not be accepted as a valid reason for an exemption. Early boostering has not been associated with an increased occurrence of adverse reactions and is not medically contraindicated. Name of Veterinarian Print License Number Address Signature of Vete...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ VPH-28

Edit your NJ VPH-28 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ VPH-28 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NJ VPH-28 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NJ VPH-28. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ VPH-28 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ VPH-28

How to fill out NJ VPH-28

01

Begin by downloading the NJ VPH-28 form from the official website.

02

Fill in your personal information, including your name, address, and contact details.

03

Indicate the type of request you are making in the provided section.

04

Provide any necessary documentation or evidence to support your request.

05

Review the form for any errors or omissions.

06

Sign and date the form at the bottom.

07

Submit the completed form via the specified submission method (mail, email, or in-person).

Who needs NJ VPH-28?

01

Individuals or organizations applying for a specific request related to health or public safety in New Jersey.

02

Residents seeking access to public health records or information.

03

Businesses needing to comply with state regulations regarding public health.

Fill

form

: Try Risk Free

People Also Ask about

Is rabies vaccine mandatory in Michigan?

Michigan law requires that dogs and ferrets must be vaccinated for rabies and it is recommended that all cats and any domestic livestock in contact with the public be vaccinated if a licensed vaccine exists.

What does rabies exempt mean?

• Dogs approved for a rabies vaccine exemption are considered unvaccinated and. must abide by rabies laws for unvaccinated pets. • Exemptions are only valid for 1-year. Permanent exemptions do not exist. • California does not accept positive rabies titers in lieu of a rabies vaccine.

Can I refuse to vaccinate my child in Michigan?

Michigan allows philosophical and religious waivers, which means that no one seeking an immunization waiver for their child is denied. If a child can't receiving a vaccine because of a medical condition, they will need a medical exemption form from their doctor's office.

Do I have to vaccinate my child for school Michigan?

Knowing school vaccination rules helps ensure your child is ready for school. Michigan students are required to have these vaccines: Diphtheria, tetanus, acellular pertussis (DTaP) Polio.

Is it illegal to not vaccinate your child in Michigan?

Here's what to know about Michigan's vaccine law So what does Michigan law say about vaccines? The Michigan Public Health Code requires parents to immunize their children against illnesses like polio, diphtheria, tetanus, and pertussis (whooping cough). The law is enforced whenever and wherever children gather.

How do i get a vaccine waiver in Michigan?

Immunization Waivers To obtain a medical waiver, please make an appointment with your health care provider and have them complete a Medical Contradiction Form. To obtain a non-medical waiver, you will need to make an in-person appointment with a Mid-Michigan District Health Department nurse.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the NJ VPH-28 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign NJ VPH-28 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit NJ VPH-28 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign NJ VPH-28 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I edit NJ VPH-28 on an Android device?

You can edit, sign, and distribute NJ VPH-28 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is NJ VPH-28?

NJ VPH-28 is a form used by the State of New Jersey for reporting certain vehicle registrations and related information.

Who is required to file NJ VPH-28?

Individuals and businesses that engage in vehicle sales or that are involved in vehicle leasing must file NJ VPH-28.

How to fill out NJ VPH-28?

To fill out NJ VPH-28, provide the required vehicle details, including VIN, make, model, and other pertinent information, ensuring all fields are completed accurately.

What is the purpose of NJ VPH-28?

The purpose of NJ VPH-28 is to collect data on vehicle registrations and ensure compliance with New Jersey's vehicle laws and regulations.

What information must be reported on NJ VPH-28?

NJ VPH-28 requires reporting information such as the vehicle identification number (VIN), make, model, year, and details about the owner or lessee.

Fill out your NJ VPH-28 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ VPH-28 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.